Forex Trading Alert originally sent to subscribers on July 17, 2014, 4:26 PM.

Earlier today, the U.S. dollar moved lower after news that a Malaysian Airlines plane crash near the Russia-Ukraine border, which fueled fears that the crisis between countries will escalate. These circumstances encouraged investors to abandon the dollar and buy safe-haven assets such as gold. As a result USD/JPY declined sharply and erased most of the recent rally. Will we see further deterioration in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order: 1.3670)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

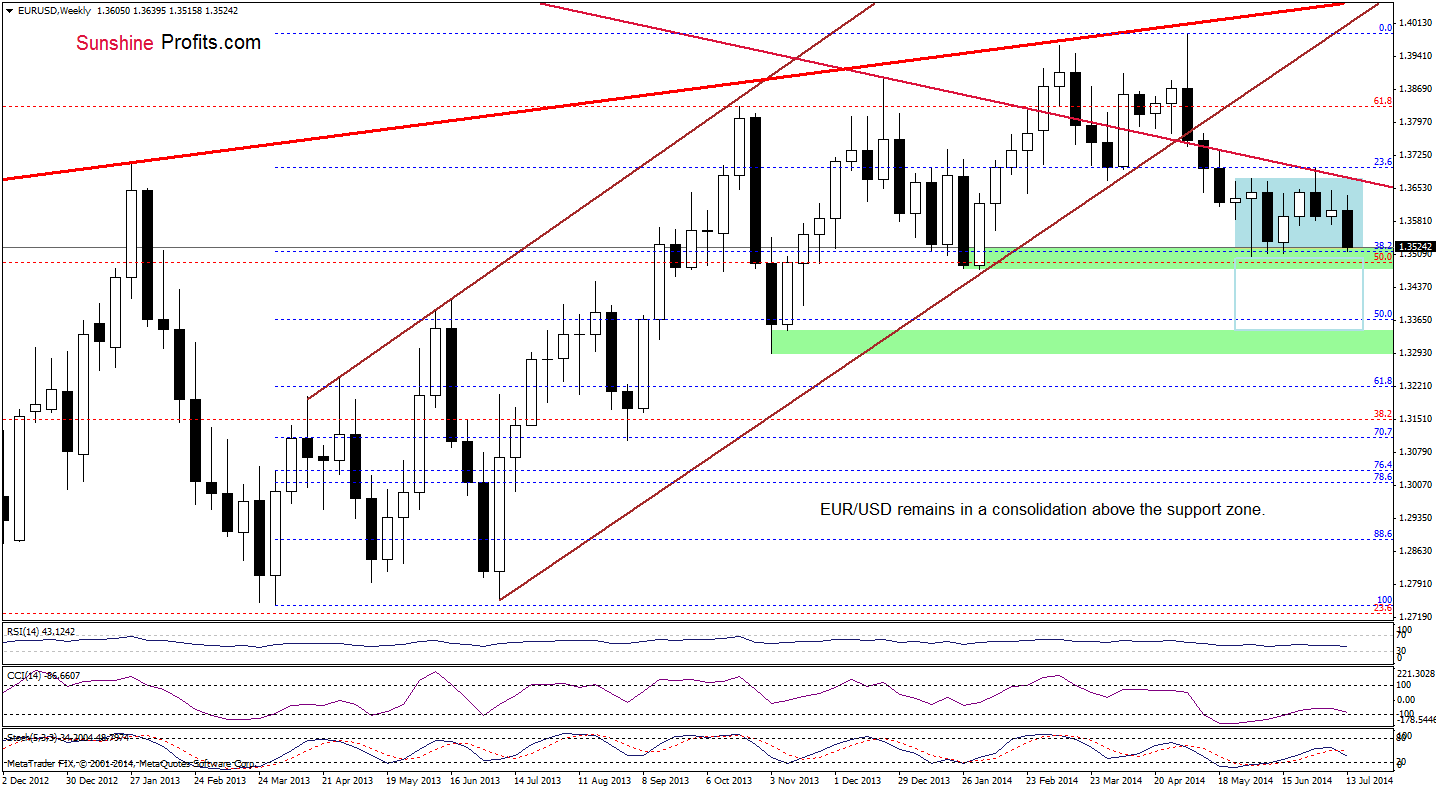

From the weekly perspective, the overall situation hasn’t changed much as EUR/USD still remains slightly above the lower border of the consolidation. Therefore, what we wrote yesterday is up-to-date:

(…) this area is reinforced by the 38.2% Fibonacci retracement and the June and February lows. If this strong support zone withstand the selling pressure, we’ll see another attempt to break above the upper border of the consolidation and the long-term resistance line (similarly to what we saw at the beginning and also in mid-June). However, if currency bulls fail and the pair moves lower, we may see a drop even to around 1.3320, where the size of the downswing will correspond to the height of the consolidation.

Once we discussed the medium-term outlook, let’s check what can we infer from the daily chart.

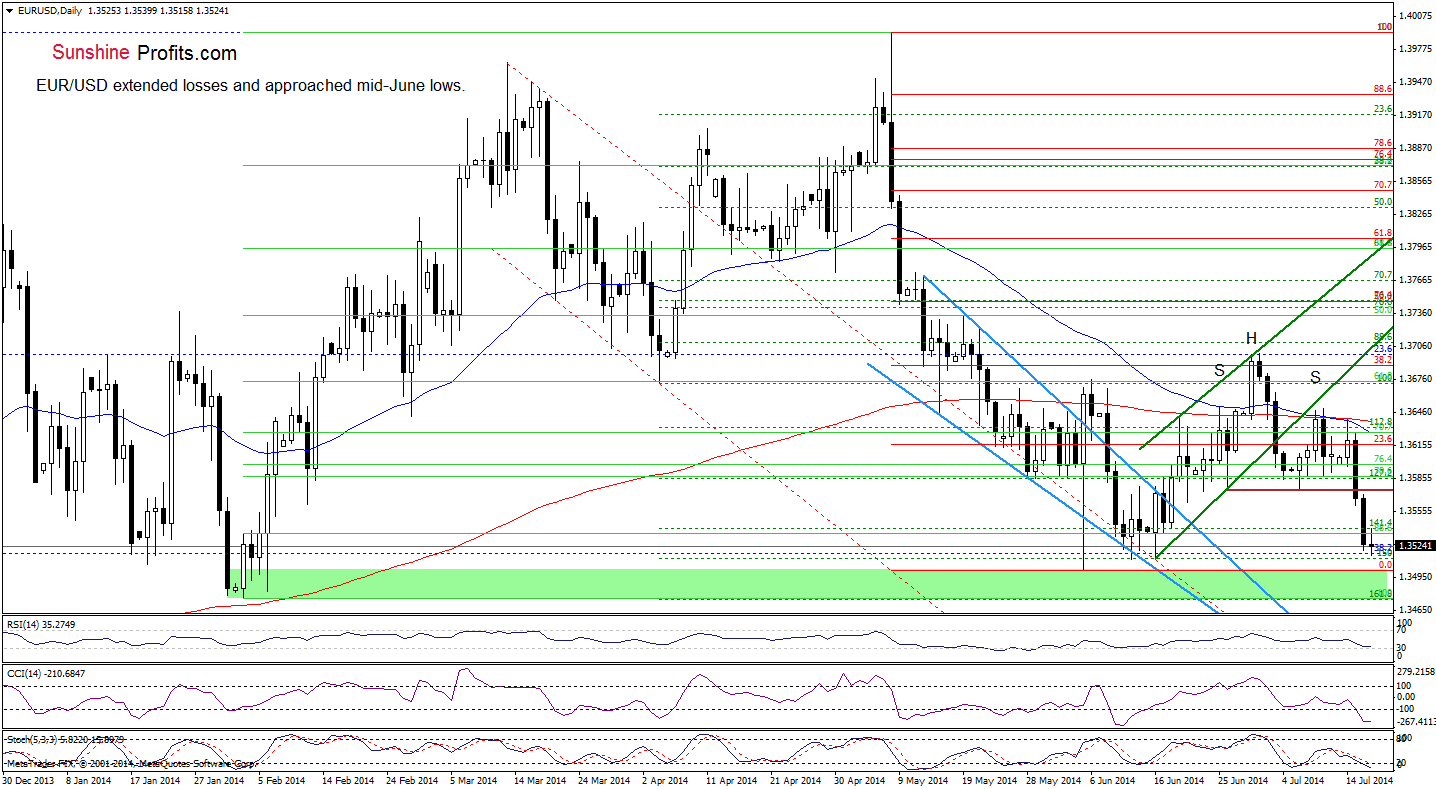

In our Forex Trading Alert posted on July 9, we wrote the following:

(…) we’ll see a correction to the neck line based on the June 26 and July 7 lows (but further deterioration will be even more likely if the pair drops below the green support zone). If this area is broken, the exchange rate will test the strength of the June lows (…)

Looking at the above chart, we see that EUR/USD moved lower and almost reached its initial downside target. If this area holds, we may see a corrective upswing to the previously-broken neck line of the bearish head and shoulders reversal formation. However, if it is broken, the next target for currency bears will be around 1.3476, where the February low is. Please note that although the CCI and Stochastic Oscillator are overbought, they didn’t generate buy signals, which supports the bearish case at the moment.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): Small short positions (using half of the capital that one would normally use). Stop-loss order: 1.3670. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

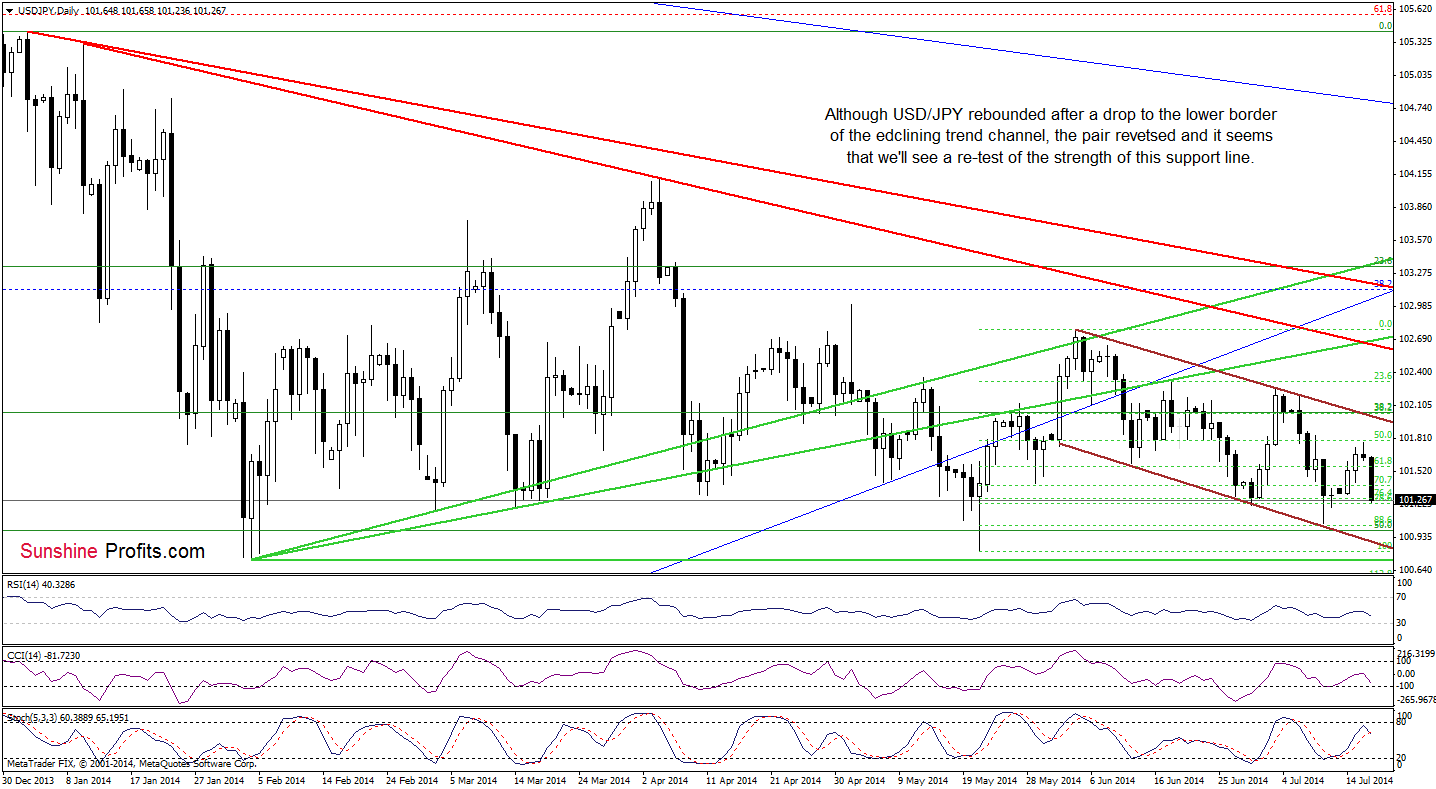

The medium-term picture remains unchanged as USD/JPY still remains between the medium-term support/resistance and the May low of 100.81. In our opinion, as long as there is no breakout above the nearest resistance (or breakdown below the major support) another sizable move is not likely to be seen.

Having say that, let’s find out what can we infer from the very short-term picture.

Quoting our last commentary on this currency pair:

(…) the pair almost touched the 88.6% Fibonacci retracement and reached the lower border of the declining trend channel (marked with brown). Taking these support lines into account, we think that the space for further declines might be limited - especially if the CCI and Stochastic Oscillator (which are currently oversold) generate buy signals in the coming days.

As you see on the daily chart, currency bulls took their chance and pushed the exchange rate higher at the beginning of the week. Although we noticed an increase in the recent days, it turned out that this was a short-lived rally as the pair reversed after a climb to the top of the previous corrective upswing (the July 9 high). Today, USD/JPY declined sharply and erased most of earlier gains. What’s next? Taking into account the current position of the indicators, it seems that the exchange rate will move lower in the coming day (or days) and drop to the July low of 101.05. If this support level withstand the selling pressure, we’ll see a rebound to yesterday’s high, but if it is broken, currency bears will test the strength of the lower border of the declining trend channel (currently around 100.89) once again.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

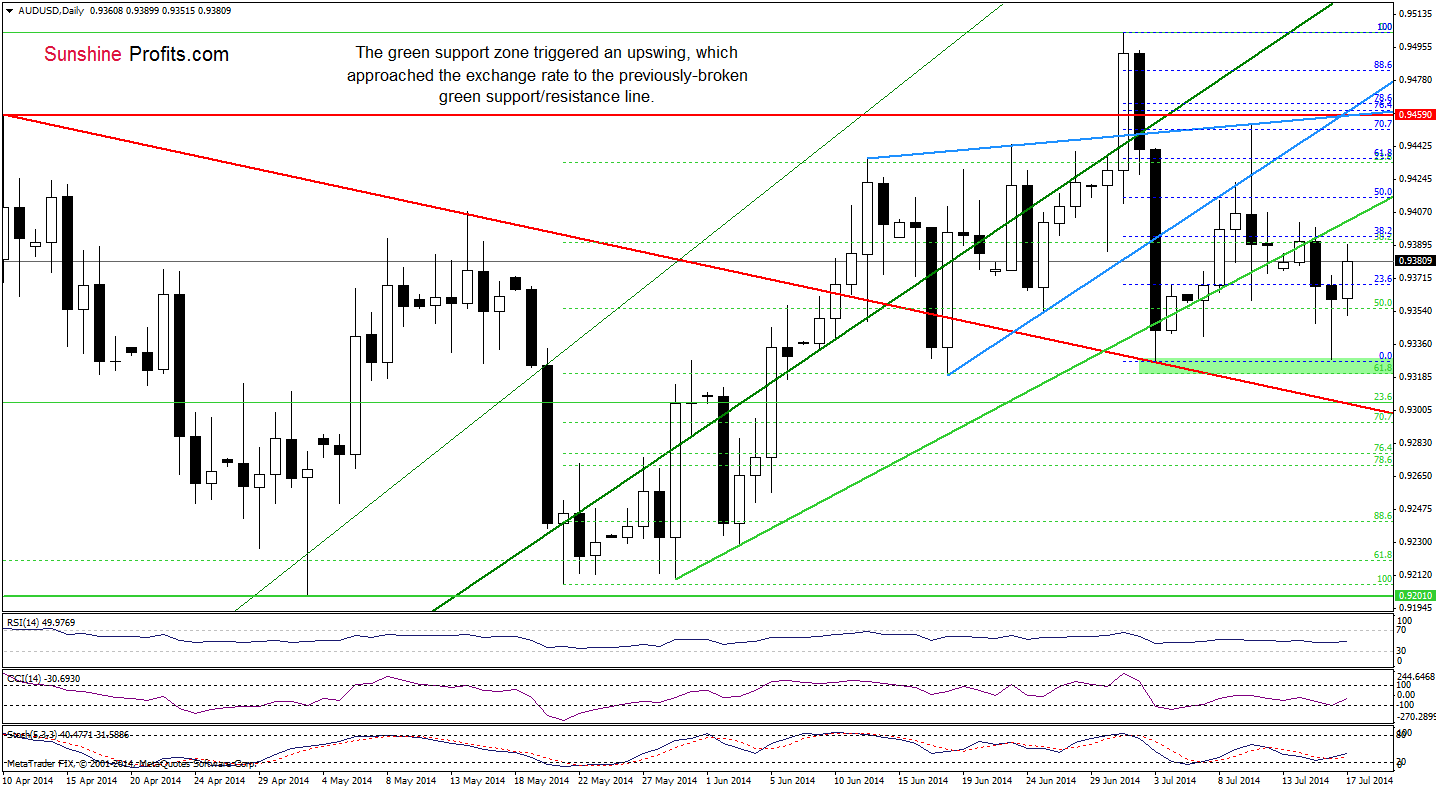

The medium-term outlook remains mixed as AUD/USD is still trading in a consolidation between the May lows and the April high. Today, we’ll focus on the very short-term changes.

Quoting our previous Forex Trading Alert:

(…) the support level in combination with the 61.8% Fibonacci retracement triggered a corrective upswing that took the pair above yesterday’s low. This is a positive signal, which suggests that if currency bulls do not give up we’ll see an increase to the previously-broken green support line.

Earlier today, AUD, USD extended gains and approached the above-mentioned upside target. If the proximity to the nearest resistance encourages forex traders to push the sell button, we’ll see a pullback to the green support zone. Nevertheless, taking into account the current position of the indicators, it seems that the pair will move higher in the coming day (or days) and invalidate the breakdown below its key support/resistance line. If this is the case, the upside target will be around 0.9454, where the strong resistance zone (created by the July 10 high, the 70.7% Fibonacci retracement and the upper line of the rising wedge) is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts