The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold articles.

In Europe, concerns about the euro remain prevalent. According to Financial Times Deutschland, the European Central Bank and several Euro-zone nations are asking Portugal to follow Irelands lead by applying for bailout. Tensions on the Korean peninsula further boosted the appeal of the greenback.

Joseph Capurso from the Commonwealth Bank of Australia said that, Portugal and Spain have shaky government finances, so their bond markets might go through a period of selloff. In that sort of environment, you would expect the euro to sell down further. The common currency has declined by 2.9 percent several weeks ago.

One of the main reasons why Portugal is being asked is to reduce the pressure on Spain. Borrowing costs for EUs indebted nations are surging because of Irelands capitulation in accepting bailout. This move also stoked speculations that other nations might eventually have to seek aid. Average yield on a 10-year from Portugal, Ireland, Greece, Spain, and Italy have reached 7/52 percent, a record.

Meanwhile, Irish Finance Minister Brian Lenihan revealed that the final size of the bailout from the International Monetary Fund and European Union is not yet known although 85 billion euros has been mentioned. The government intends to cut spending by 20% even as it raises taxes in over the next four years.

Despite these best efforts, the Irish bailout and austerity plan was not sufficient to calm the jittery market. Investors are now turning their attention to Portugal. David Forrester of Barclays Capital based in Singapore said that, gains in euro-area bond yields relative to Germanys places downward pressure on the euro.

The additional yield that is demanded by investors to hold Irish 10-year bonds rose to 6.32 percentage points while Portugals rose by 4.31 points against their German counterparts. Overall, European research institutes expect that recovery will remain tentative in the next two years. It also faces setbacks if debt worries arent resolved.

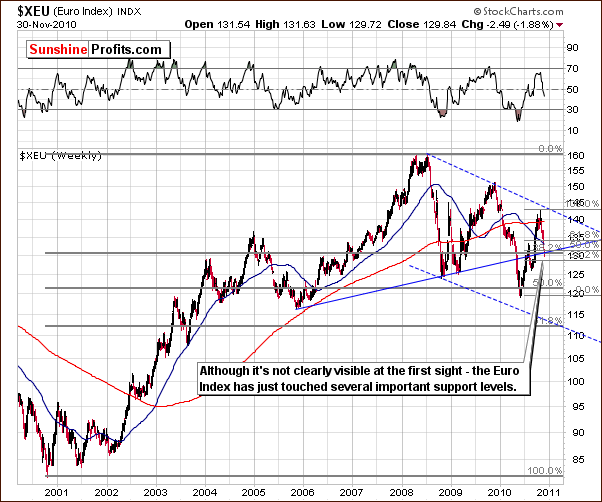

Euro Index

A quick look at the Euro Index chart shows that tensions in Ireland and Portugal have most probably contributed to the declines seen in the Euro Index levels. Though the decline has been rapid, it should be noted that it has stopped at several resistance lines. One resistant line is the rising support levels established upon the 2005 and 2009 bottoms. Another line is the 50% retracement of the recent upswing and the third is the 38.2% retracement of the 2000-2008 rally.

Gold Prices and the Labor Market

The downbeat job data pushed the dollar lower last Friday. It also sent gold prices soaring to $1,414 an ounce and silver to $29.35 an ounce. The Wall Street Journal reports that The US economy added fewer jobs than expected in November and the unemployment rate rose to 9.8%, its highest level since April. The figure reveals the recovery remains weak 17 months after the recession ended. The US dollar has weakened against major currencies such as the yen and euro.

US employers added only 39,000 jobs this November, which is a sharp slowdown compared to October. According to the Labor Department, jobless rate jumped to 9.8% from 9.6% partly because more people started looking for work. This report contradicts the optimistic string of data that was seen in recent weeks.

The latest figures underscore the fact that the recovery is still fragile. While employers are no longer cutting jobs, they also remain cautious about hiring more workers amid weak consumer sentiment. Last November, private-sector companies hired 50,000 jobs which offset the 11,000 drop in government payroll.

Despite these, consumer sentiment has improved last November its highest level since June. Last month, auto sales have also jumped 17% from a year early. Housing data has also improved. Other positive factors include increased construction spending and improved factory output.

Given consumer sentiment (which accounts for 70% of the demand) data and the jobless rate, Credit Suisse chief economist Neal Soss said that, The real world probably is not doing quite as poorly as these data suggest that is not to say the reality is satisfactory.

Can the Dollar become the Worlds Weakest Currency?

Is it possible for the US dollar to become the worlds weakest currency? Analysts at the JPMorgan & Chase Co. seem to think so. The firm reports that the greenback may fall below 75 yen next year because of the Feds monetary easing program. Together with central banks in Japan and Europe, the US central bank is keeping the interest rates at record low to boost economic growth.

According to Tohru Sasaki, head of Japanese rates and foreign-exchange research at JPMorgan & Chase, The US has the worlds largest current-account deficit but keeps interest rates at virtually zero. In addition, he revealed US policy makers may need to implement additional easing measures depending on the labor market and inflation following the $600 billion bond-purchase program.

Last November 3, the Fed announced that it will buy $75 billion worth of Treasuries every month until June to limit borrowing costs. The Fed has kept the benchmark rate at zero to 0.25 percent since December 2008. Meanwhile, the Bank of Japan intends to keep its benchmark overnight rate at 0.0% to 0.1%. It has also set up a $59.9 billion asset-purchase fund.

The US currency is now trading at 83.38 yen after falling to a 15-year low of 80.22 on Nov. 1. This is very near the post-World War II low of 79.75 which occurred in April 1995. The dollar has already declined against 12 out of the 16 most-traded counterparts in 2010.

Tension in the Korean Peninsula

Another important development in the headlines which may affect the movement of gold is the tension in the Korean peninsula. North Koreans state-run Korean Central News Agency said that the planned naval exercises by the US and South Korean moved the peninsula closer to the brink of war. The exercise comes after North Korean shelled a South Korean Island. President Obama reiterated US support for the South and has dispatched the USS George Washington to take part in military drills from November 28 to December 1 in the Yellow Sea.

One interesting benchmark for the dollar recently comes from the Japanese yen. Japan is watching the events unfold carefully as any event in the two Koreas would have a significant effect on their country as well. North Korea has warned that escalated confrontation would lead to war. According to Masanobu Ishikawa from the Tokyo Forex & Ueda Harlow Ltd said that because Japan is geographically close to Korean, this may be causing some buying of the dollar and selling of the yen. South Korean won also dropped by 1.9 percent, its sharpest decline since June 25.

If you are interested in knowing more on the market signals we analyze, we encourage you to subscribe to our Premium Updates to read the latest trading suggestions. We also have afree mailing list - if you sign up today, you'll get 7 days of full access to our website absolutely free. In other words, there's no risk, and you can unsubscribe anytime.

Thank you for reading.

Rosanne Lim

Sunshine Profits Contributing Author

--

We have sent out an important timing-related message to our Subscribers today. We encourage you to Subscribe to the Premium Service today and read the full version of today's analysis right away.