Visit our archives for more gold & silver articles.

Gold rose sharply Wednesday after a European Central Bank council member suggested the possibility that Europe’s rescue fund could get a banking license, allowing it to tap cheap ECB funding. The rally was also supported by reports that the Federal Reserve is getting ready to implement another round of stimulus. The Wall Street Journal reported Wednesday that the Fed is growing uneasy over the sluggishness of the U.S. economy and the unemployment rate. Gold market showed some strength this week but is this really a beginning of a new rally?

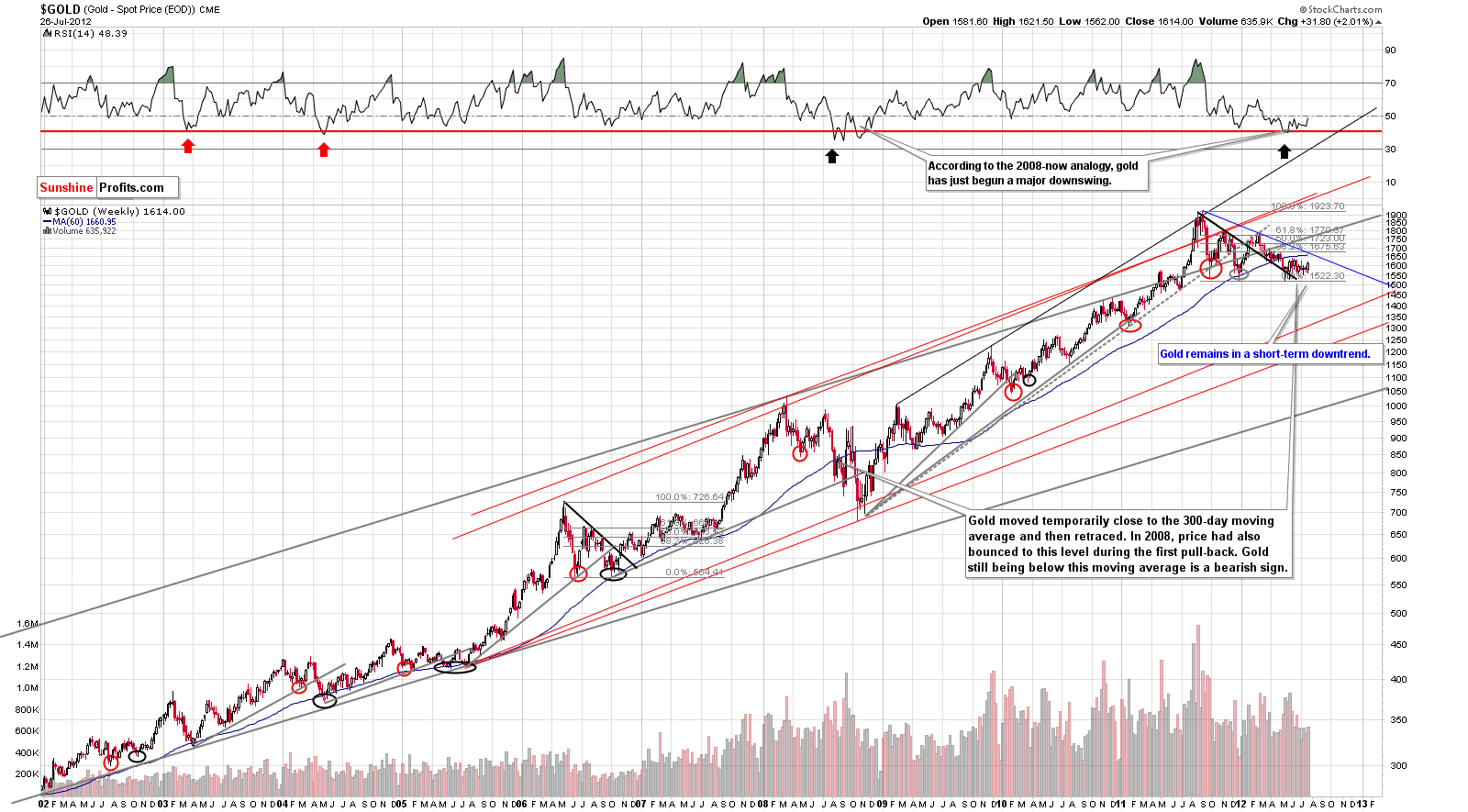

Let’s have a look at gold’s chart right away and try to figure out whether these recent moves have much meaning for the upcoming weeks (charts courtesy by http://stockcharts.com.)

In the very long-term chart of the yellow metal (if you are reading this essay on sunshineprofits.com, you may click the above chart to enlarge), the situation is unchanged in spite of the rally this week. The trend still remains down from here and with RSI levels now close to 50, gold is no longer oversold.

When it comes to gold’s short-term performance, we need to mention that the short-term resistance line has not yet been crossed and it is quite hard to tell whether this will happen based on gold price alone. Such an event would influence the short-term outlook significantly – a breakout would likely be followed by a significant rally, but since it was not yet seen, the implications are not bullish.

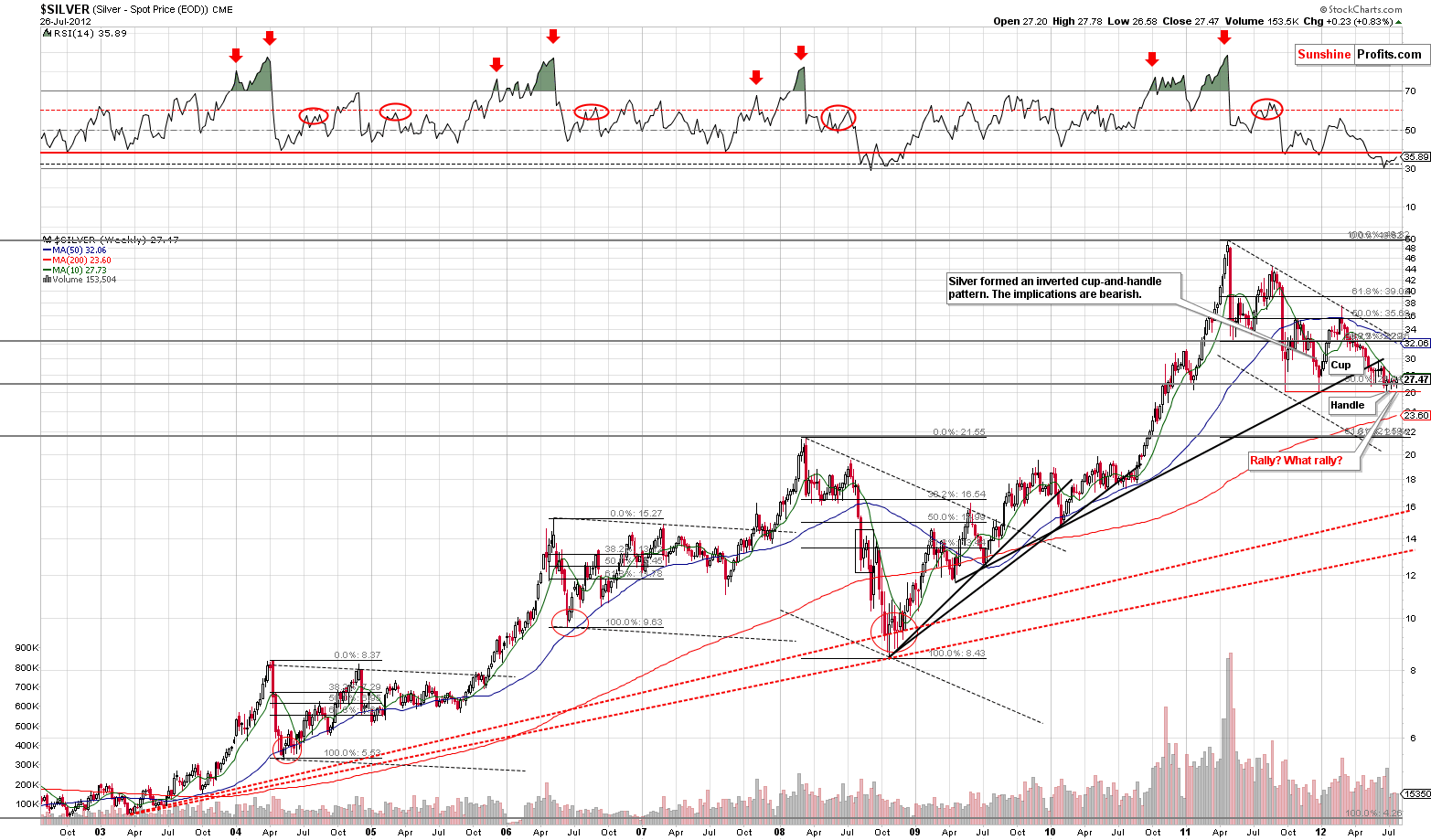

Now, let’s have a look at the white metal’s chart as it also seems to have experienced a rally.

While the rally was seen if one monitors the precious metals market on a daily basis, the very long-term chart for silver (if you are reading this essay on sunshineprofits.com, you may click the above chart to enlarge) reveals that this week’s rally is basically invisible. Silver saw a small move to the upside, which was stopped by the 50-day moving average. There was no breakout above this line.

And what about the short term? The inverted cup-and-handle pattern is still in place and still has bearish implications. This 50-day MA provided resistance during the pullback back in 2008 and may play an important role this time as well.

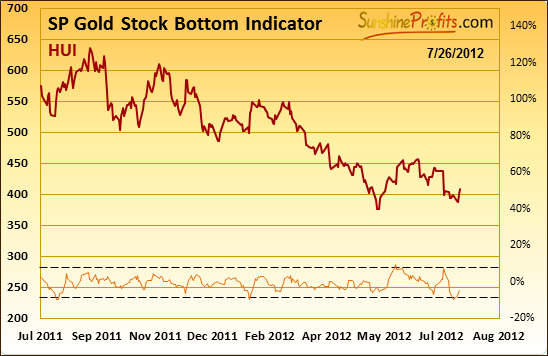

Finally, let’s take a look if one of our own indicators suggests that a bigger rally is in the cards.

As you may see above, the indicator touched the lower dashed line, which is a buy signal. However, it was very close to this level just a few weeks ago and only a small rally followed. So, a small move to the upside was very much in the cards, but this is not enough to claim that a reversal in the trend will be seen.

Summing up, the recent moves in precious metals are more of a pullback than a real rally. They could turn into a rally if something (like a rally in oil or breakdown in the USD Index) pushes them higher and they break above their respective resistance levels, but this remains to be seen. We encourage you to join our subscribers, who have already read today’s Premium Update that deals directly with factors that could impact the situation for silver, gold, and mining stocks (with emphasis on the USD Index).

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold rallied strongly even though dollar declined modestly on Wednesday and it rallied quite insignificantly despite dollar's big one-day decline on Thursday. Should you - the precious metals investor - be concerned with this perplexing action? Since the situation in the USD Index is the key factor for gold's, silver's and - especially - mining stocks moves, we elaborate on this important issue in today's Premium Update. We initially commented on it in this week's Market Alert, but today we cover it in much greater detail.

Today's Premium Update includes 2 price targets for gold, 2 price targets for silver and 2 price targets for the HUI Index (and corresponding GDX levels) and all of them are supported by appropriate charts. In fact, the cyclical nature of the silver market is something that allows us to draw conclusions that at first sight appear counter-intuitive. We also comment on our in-house developed indicators that flashed buy signals for precious metals this week and we focus on the "will the rally last?" question. Additionally, we comment on the recent developments on the crude oil market (the situation has become clearer this week). We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.